CHAPTER 7

CHAPTER 7

CHAPTER 7 is the simplest and most common form of bankruptcy available: the debtor exchanges their non-exempt assets, if any, for the release of their dischargeable debts. In nearly all consumer cases, however, the debtor’s property is exempt and is excluded from the bankruptcy estate.

CHAPTER 11

CHAPTER 11

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

CHAPTER 13

CHAPTER 13

Chapter 13 is a form of bankruptcy, available only to individuals with regular income, where the debtor repays all or part of their debts from future income. To be eligible for Chapter 13, the debtor’s secured debt (mortgages, car loans and tax liens, etc.) must be less than $1,184,200 and unsecured debt must less than $394,725.

Bankruptcy Center

We are here to assist you with bankruptcy resources in these troubling financial times. Please click below to provide us with your contact information and enjoy free access to our resources center.

In response to the Covid-19 outbreak the Bankruptcy Center, LLC was formed to give individuals the resources and assistance they need file for bankruptcy.

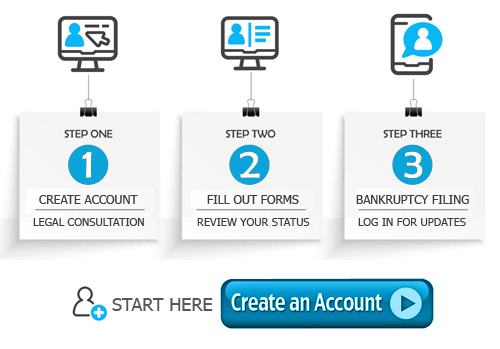

HOW IT WORKS ?

The first step is to review all the resources available and ask us any questions you have about bankruptcy generally. You will then request for a quick consultation OR create your account and review the list of documents needed for a consultation and complete our preliminary questionnaire. Then you can schedule a consultation with us and upload the documents and completed questionnaire.

OR -- CREATE AN ACCOUNT

Your first step is to create an account to set up a consultation with an experienced bankruptcy lawyer. The initial bankruptcy consultation is a first meeting, usually lasting between 30-60 minutes, in which your bankruptcy attorney gets a feel for the financial issues you are confronting and how best to address them.

WHAT OUR CLIENTS SAID ABOUT US

Wes and Melinda

We were referred to CA Bankruptcy center by a friend. They helped us through rough time. We were in process of losing our house and we had a sale date, and we wanted to act fast. They acted quickly and saved our house and helped us with creditors in much less stressful situation. I highly recommend to use California Bankruptcy center.

Augustine R

I had a business that didn't do well, I used all my credit cards until become full. My business went down and I needed to file for bankruptcy. I found CA Bankruptcy Center and they helped me with my debts to make a good deals and settlement with my creditors, they lower my bills and interest rate. Without them I wouldn't being able to keep my business.

Allan P.

When my salary cut back and I couldn't pay my bill, I had to figure out what to do, I was referred by a lawyer to California Bankruptcy Center. They explained all different options available to me because every case is different. It took me two weeks to make the right choice. Filing for Bankruptcy was a long process but it was easy because in every step they explained what was going to happen or what could happen. I felt very comfortable with the process. In the end, I did go through the bankruptcy successfully, my debts were discharged. Like a red reset button in my finances.